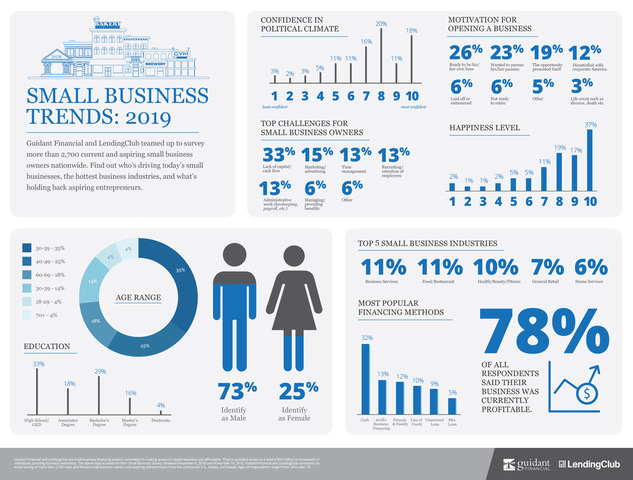

In a follow up to last years 2017 survey, Guidant Financial has released its “State of Small Business 2018” survey of men and women small business owners and entrepreneurs with an eye on what to expect in 2019. Overall it uncovered that the majority of small business owners continue to feel happy and confident in today’s uncertain political climate, amongst many other findings.

The survey asked more than 2,700 current and aspiring small business owners about their views on the current state of small business with questions ranging from their confidence in the economy to obstacles they faced pursuing business ownership.The survey yielded valuable trend information on the U.S. small business economy.

Key takeaways include:

o 78% businesses are profitable

o Happiness average rated an 8 with 53% of business owners at 9+

o Confidence in political climate average a 7 with a 48% increase in owners at 8+

o 33% had only a high-school degree, showing a degree isn’t necessary to be a successful small business owner

o #1 reason people go into business – “Ready to be their own boss” with 26% of the share and not far behind is those that “wanted to pursue their own passion” at 23% of the share

o 15% increase in employee recruiting and retention challenges

o 34% increase of health, beauty, and fitness businesses

o 57% of small business owners are boomers aged 50+, 25% are aged 40-49, and 18% are millennials aged 18-39

Below is a graph and more information revealed in the survey which we hope you will find of interest.

In addition, we encourage you to contact us to speak directly to Guidant Financial CEO David Nilssen who can provide a wealth of knowledge on the survey as well as the state of small business in America. Please contact me should you want more information/artwork, have any questions or wish to speak with David. We appreciate your time and consideration.

Best,

Stacia Kirby, principal

stacia@kirbycommuincationsinc.com

(o) 206-363-1492

Report on The State of U.S. Small Business In 2018

Report on The State of U.S. Small Business In 2018

Overall, American small business owners are approaching 2019 with economic optimism and increased confidence in this lucrative environment, according to a survey from small business financing company Guidant Financial and online credit marketplace LendingClub Corporation (NYSE: LC). The companies surveyed more than 2,700 current and aspiring small business owners about their views on the current state of small business with questions ranging from their confidence in the economy to obstacles they faced pursuing business ownership.

Here’s a look at current small business trends and what to expect in 2019.

Motivation

With very little change from year to year, most small business owners choose to go into business because they were “ready to be their own boss” (26 percent) or to “pursue their own passion” (23 percent).

Outlook

Current business owners rated their level of happiness as an average of eight on a scale of one to 10 (10 being the happiest). A substantial 53 percent surveyed ranked their happiness at nine or above.

Small business owners are also confident in the state of small business in today’s political climate. Only 24 percent of small business owners surveyed rated their confidence under five on a scale of one to 10 (10 being the most confident). As in the previous year, the average small business owner’s answer on the confidence scale was seven.

Challenges

Employee recruiting and retention grew as a challenge in 2018. Small business owners reported a significant 15 percent increase in challenges with recruiting and retaining employees. The majority of small business owners (41 percent) only employ two to five employees.

Similar to 2017, the majority of small business owners considered a lack of capital or cash flow one of their major challenges, followed closely by trouble with marketing and advertising, time management, and administration work.

Demographics

Small business continues to be ruled by boomers. 57 percent of small business owners surveyed were over the age of 50, a small increase year over year. 73 percent are male and 25 percent female.

Education

While the overall percentages of education in small business owners hasn’t changed dramatically from 2017, there are great shifts in the share of levels of higher learning. There was a 32 percent increase for doctorates and a 9 percent increase for Master’s degrees. Despite the changes, the largest segment of education remains at the high school level, at 33 percent.

Profitable

78 percent of all respondents are currently profitable, a 6 percent increase from the previous year. A 37 percent majority are well-established entities with experienced owners that have been operating for over a decade. Half of profitable businesses were purchased as an independent business already in operation, while independent start-up businesses were the next largest segment, at 39 percent.

Top Business Industries

2018 brought a notable increase in health, beauty, and fitness businesses such as wellness spas, salons, and gyms with a 34 percent increase. There was a rise in food businesses and restaurants, a 14 percent increase. Business services continued to reign as the largest segment, at 11 percent. Home services overtook automotive businesses this year for the 5th spot.

Financing

While the top five forms of funding remained the same as 2017, there were numerous shifts in less-utilized forms of financing. The share of mortgage refinancing increased by 33 percent, SBA loans grew by 29 percent, and home equity line of credit (HELOC) grew 27 percent.

Cash remains the most popular funding method with 32 percent. Rollovers for Business Start-ups (ROBS), a method of using retirement funds to start a business without incurring tax penalties, remains in second place at 13 percent.

An accompanying infographic can be found at https://www.guidantfinancial.com/learning-center/infographics/2019-small-business-trends/.

Methodology

Between November 6, 2018 and November 16, 2018, Guidant Financial and LendingClub conducted an email survey of more than 2,700 male and female small business owners and aspiring entrepreneurs from the continental U.S., Alaska, and Hawaii. Ages of respondents ranged from 18 to over 70.