Since the recession of 2007- 2009 we have seen a constant stream of gloom and doom. Many argue that bull markets die of old age, but I have never known that to be the case. Had investors listened and traded out of the equity market they would have missed tremendous opportunities for growth. As always, we recommend selecting a long-term strategy that you are personally comfortable with and sticking with it through the inevitable ups and downs in the market. In our experience, the equity market tends to climb a “wall of worry” and fall in a “euphoric flash”. We certainly do not have a great deal of euphoria currently, but we are hearing much from the news pundits about how we should be worrying.

At Guardian Rock Wealth and Marc J Lane Investment Management, we spend a great deal of time studying and analyzing trends so that our clients don’t have to. We specifically do not update our readers or clients daily or even weekly unless you specifically ask us a question. We encourage long term planning meaning investing consistently over the long term.

The following is our quarterly review of where we believe the markets may be headed:

There continues to be a great deal of political argument which has caused increased volatility over the past two quarters. The continuing trade war and threats of a real shooting war continue. Additionally, several new governors have been elected across the U.S. and have instituted more localized tax schemes which have begun to impact consumer behavior. Combine those local tax law changes with the recent new Federal tax laws which have just begun to make their impact known and you start to realize that the consumer has many new things to consider when making purchases and choosing appropriate savings and investments. Add to that the FOMC speculation that we may see interest rates cut to stimulate the economy and short-term investors have all the makings for an ulcer!

THE BOTTOM LINE

For those of you that just want to read the proverbial bottom line, our position is that we see continuing, largely politically driven volatility both to the upside and downside (I find it interesting that most investors view volatility negatively only when the market is falling). We take Fed Chairman Powell at his word and expect a rate cut or two before the end of the year and quite possibly as early as this month. We believe we have just begun to see the impact of the tax law changes that are likely to have unintended and intended consequences over multiple years to come. We are also concerned that the implications of a prolonged trade war may start to surface over the next several months. Due to this, a prolonged inverted yield curve and a few other troubling signs, we are adopting a more defensive posture. Short of a complete rollback of most if not all tariffs, something we believe is unlikely, we believe any stimulation action by the FOMC will have little long-term impact.

The good news is that we do not see the type of major exuberance in the marketplace that tends to precede major market downturns. Employment and wages remain within healthy ranges and while the trade war has hurt many companies, we are seeing the management of solid companies making prudent adjustments to their supply lines and the way they do business to adapt. We also do not see the over- leverage that was prevalent during the last downturn.

Why we are not overly concerned about the markets currently:

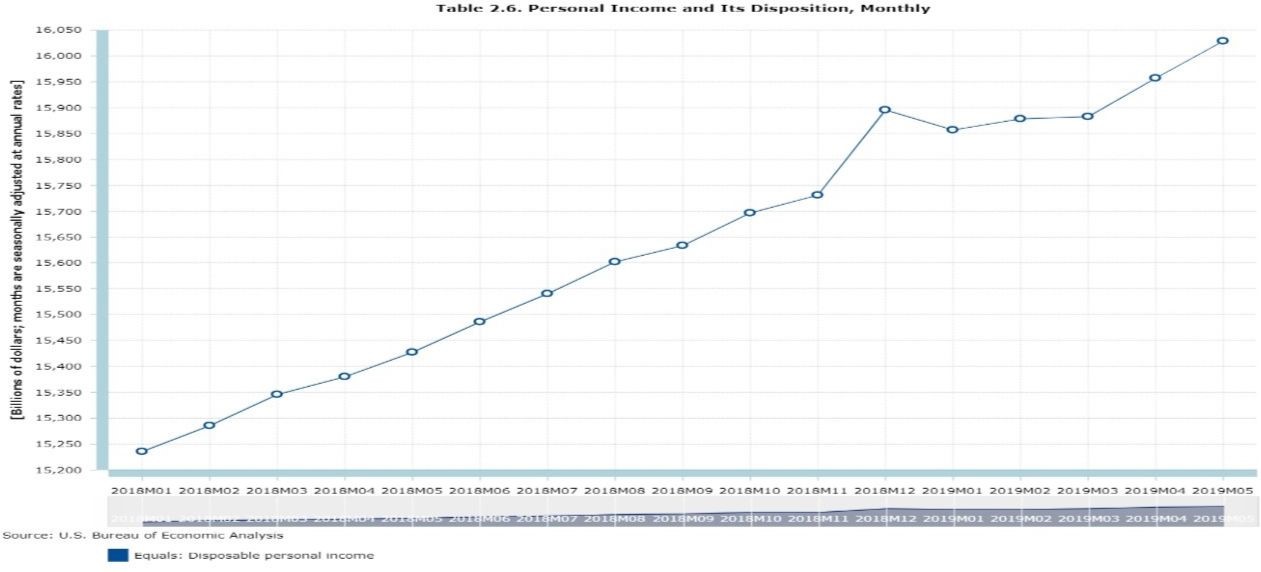

Employment remains at very high levels and when people work here in the United States, they become consumers and the American consumer continues to drive the lion’s share of economic progress. Further, employment in lower-paying jobs is increasing while tax payments are decreasing giving this segment of the economy more disposable income. Typically, this segment of the economy consumes more as a percentage of their income than the more affluent which should have a positive impact on the economy. As for verification that the consumer continues to be alive and well, retail sales remain high despite continued dire warnings from many economists. You can see in the chart below that disposable personal income continues to rise after a hiccup in the early part of the year showing again that the American consumer continues to have a steady supply of funds to spend.

Despite the dire warnings, economic indicators such as industrial production, Housing, and inflation numbers remain within comfortable ranges. The FOMC news that they are likely to lower rates may be the best-known good news. The market has priced in and the Fed has indicated they will drop rates as early as this month adding further fuel to the consumer fire. This will also make it easier for businesses and local governments to spend more to keep the economy humming along. Further, Gross Domestic Product continues to remain within healthy ranges despite the trade war, with 49 of the 50 states reporting an increase in state GDP this economic strength seems to be broad-based.

Why we still remain cautious:

The Duke-CFO Global Business Outlook survey recently indicated that more than two-thirds of corporate chief financial officers expect that a recession will be underway by the end of 2020. The current tariff war and its consequences are likely to continue for quite some time and will likely continue to put the brakes on our economy as well as many overseas economies. Longer-term, a major issue with prolonged tariffs is that most companies are now exposed to the growing Chinese middle-class consumer who is the one likely to be hurt the most as the tariffs continue. While some earnings numbers continue to be impressive, many companies are beginning to forecast earnings warnings for future quarters. Stimulation by the FOMC should help but they simply do not have as much room to move as they have had in the past. Interest rates are already low and previous Quantitative easing efforts have not been entirely unraveled. We also note that, historically speaking, a pullback in the equity markets has occurred about two to three months after the FOMC starts to cut rates.

Lastly, the yield curve is not to be ignored as it continues to remain in negative territory. The five-year Treasury has dipped below the 3-month yield which by itself is not a huge issue. However, the length of time it has remained inverted has us on alert for more confirmation as we move into the third and fourth quarter. The troublesome thing about the yields continuing to be so low is that those investing for income are left with fewer options with which to generate income. As a result, we continue to see many investors pushing further out on the quality spectrum which may not be advisable.

First, the debt of lesser quality companies and governments is, more susceptible to default, but more than that, a loss of liquidity could further hamper these investments. Second, the concept that the fixed income markets always move the opposite direction of the equity market and thus provide a buffer during a down equity market has not necessarily proven to be the case for decades. Third, If recent history is any guide the “truce” in the trade war is unlikely to last. As I am writing, president Trump has once again tweeted that an actual trade deal with China is “a long way off”. While tariffs help some U.S. business, they hurt many others. The idea of “America First” would seem to be a great campaign slogan, but it may ignore the fact that tariffs hurt a very large contingent of those that buy American products. Long term, higher tariffs cause a loss for both sides of the table.

Where do investors turn as the clouds gather on the horizon?

This is why Guardian Rock Wealth and Marc J Lane Investment Management exist. Investors can not eliminate the risk of the market without risking being decidedly wrong and missing out on further upside. We believe each investor should be invested in a way that reflects their unique needs and values. As such, the answer to this question is that they should turn back to their long-term plan and maintain investment discipline through the volatility. Our experience is clear on this matter; Remain consistent with long term strategies, maintaining strict investment discipline and be ready to prudently adjust as events unfold.

John Browning, CSA

CEO, Principal

As a certified financial adviser, Mr. Browning serves as the Chief Executive Officer of Guardian Rock LLC. In addition to providing oversight to the activities of the entire firm, Mr. Browning also has direct involvement in the investment committee, client interaction and with portfolio decisions impacting specifically customized portfolios.

Mr. Browning is a graduate of Cedarville University in Ohio and later obtained his MBA from Northern IL University. John is also a Certified Senior Advisor (CSA®). John brings nearly 30 years of Wall Street experience. John brings an analytical, economics and portfolio management background to combine with years of leadership and strategy experience. John has served in various executive-level roles in the financial industry at large Wall Street firms including Morgan Stanley, Invesco, Guggenheim, and Nuveen and has extensive experience managing both fixed income and equity portfolios

Copyright © 2019 Guardian Rock Wealth, All rights reserved